Warehouse Receipt Finance

Warehouse Receipt Finance

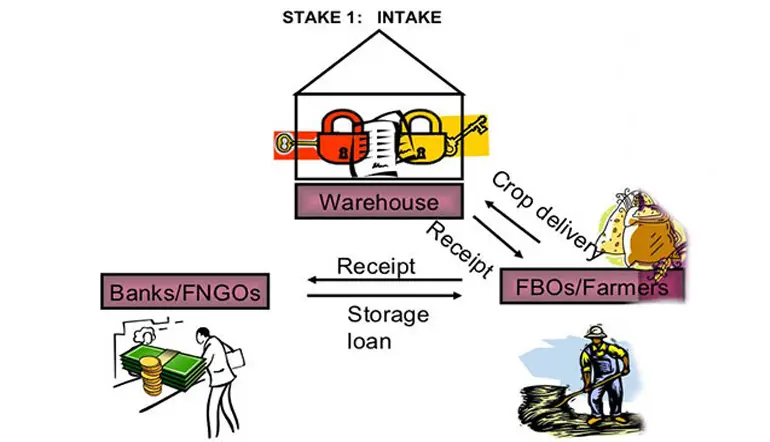

Warehouse facilities facilitate quick access to liquidity. Commodity traders can obtain warehouse receipt financing in exchange for pledging products stored in the warehouse. If the borrower fails to repay the loan, lenders will take the inventory and sell it in the market to make up the difference.

Why choose us:

- The most diverse range of deals from over 21 banks/NBFCs

- The quickest response time

- Direct Deposit to Applicant's Account

- It saves you both time and money.

- Data Safety and Security

Eligibility Criteria for Warehouse Receipt Finance

Eligibility criteria are based on a variety of characteristics such as payback history, business sales/turnover, and creditworthiness, among others.

- The applicant's age should be between 25 and 60 years old.

- A credit score of at least 750 is required.

- Indian national

Documents Required

Individual

- Two Photographs

- Pan Card Copy

- Aadhar Card + Passport

- Address Proof If Rented Also Required Permanent Address Proof

- Last 3 Years Form -16, With Computation Of Income If File

- Last 1 Year Bank Statement - Salary Account

- Loan Schedule & Sanction Letter (If Running)

- Complete Property Papers With Chain & Map +Ats

- Processing Fee Cheque In Favour Of the Bank

- Last 3 Months’ Salary Slip + Appointment Letter

Prop firm

- Photograph Both

- Pan Card Clear Copy Proprietor

- Address Proof (Pass Port, Voter Id Card) Proprietor

- Office Address Proof Latest (Electricity Bill, Telephone Bill)

- Firm Registration Certificates & GST Registration Copy

- Last 1 Year GST Return Copy

- Firm 3 Years ITR Computation, Profit Loss A/C, Balance-Sheet, Tax Audit Report, All Scheduled & Annexure

- Provisional Financial Ay 2023-24

- Bank Accounts (Current Account, Cc Account, Od Account Last 1 Year Updated)

- 6 Month Saving Account Statement Updated (Proprietor)

- If Running Any Loan Please Provide an action Letter And Repayment Scheduled

- Agreement To Sell Copy

- Property Papers With Chain Sanction Map

Partnership Firm LLP

- Photograph Partners

- Pan Card - Company, All Partners

- Address Proof - All Partners (Pass Port, Voter I Card, Pan, Adhaar)

- Firm Address Proof- Latest Any Utility Bill

- Partnership Deed Copy

- GST Certificate

- GST Return Last1 Years

- 3 Year Company ITR Coi P/L A/C Balance sheet + Audit Report 3cb 3cd, All Annexures, Scheduled With C.A. Certified

- Provisional Financial Ay 2023-24

- 3 Years all Partner Individuals ITR + Computation

- Firm All A/C Bank Statement 1 Year Updated

- All Partner Saving A/C Statement 6 Month

- If Running Any Loan – Latest Sanction Letter + Track Records Or Repayment Scheduled

- Agreement To Sell Copy

- Property Papers Complete Chain With Map

PVT LTD

- All Director’s Photograph

- Clear Pan Card - Company And All Directors

- Address Proof – Company And Directors

- List Of Director & Share Holder With Ca Certified As On Date

- Memorandum Order In Hand And Complete Copy (If Applicable)

- GST, Sale, Vat, And Ssi Registration Certificate

- 1 Year GST Returns

- All Directors Individuals ITR & Computation Last 3 Years

- Last 3 Years Complete Financial With Tax Audit Report And Annexure

- Provisional Financial Fy 2023-24 Or Month Wise Sale Figure Last 1 Year

- Company All Bank Account Statement 1 Year Updated

- All Directors Saving A/C Statement 6 Month

- If Running Any Loan – The latest Sanction Letter And Repayment Scheduled

- Agreement To Sell Copy

- Property Papers Complete Chain With Sanction Map

1. What is the maximum loan amount available through Warehouse Receipt Finance?

The maximum loan amount is determined by a number of factors, which vary from case to case.

2. What is the minimum credit score for Warehouse Receipt Finance?

To qualify for Warehouse Receipt Finance, you must have a credit score of at least 750. A higher credit score increases your chances of securing a loan, and it also allows you to negotiate better rates and terms.

3. What are the advantages of Warehouse Receivable Finance?

- Loan with Low Interest Rates

- Quick liquidity access

- Facility for a flexible tenure