EMI Calculator

Monthly EMI ₹3,639.83

Total Interest ₹136,779.34

Total Amount Payable ₹436,779.34

Amortization Chart

What is an EMI?

The Equated Monthly Installment, or EMI, is the monthly payment made to the bank or other financial institution until the debt is fully paid off. It includes loan interest as well as a portion of the principal amount to be repaid. The sum of the principal and interest is divided by the loan's term, or the number of months it must be returned. This sum must be paid every month. The interest component of the EMI would be higher at the beginning and subsequently decrease with each payment. The exact percentage allocated to principal payments is determined by the interest rate. While your monthly EMI payment will remain constant, the proportion of principal and interest components will alter over time. With each payment, you'll pay more toward the principal and less toward interest.

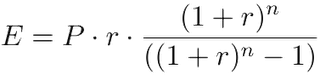

Here's how to figure out your EMI:

- E stands for EMI.

- P stands for Principal Loan Amount.

- The monthly interest rate is denoted by r. (For example, r = Annual Interest Rate/12/100. If the annual interest rate is 10.5%, then r = 10.5/12/100=0.00875)

- n denotes the loan term/tenure/duration in months.

For instance, if you borrow $100,000 from a bank for a period of 10 years (i.e., 120 months) at a rate of 10.5% annually, your EMI would be $100,000 * 0.00875 * (1 + 0.00875)120 / ((1 + 0.00875)120 - 1) = $13,493. To repay the total loan, you will need to pay $13,493 over 120 months. The total sum payable will be 13,493 * 120 = 16,19,220, which includes $6,19,220 in loan interest.

Calculating EMI by hand or in MS Excel for various combinations of the principal loan amount, interest rate, and loan duration using the aforementioned EMI method is time-consuming, difficult, and error-prone. Our EMI calculator automates this calculation for you and provides you with the answer in a split second, along with visual charts illustrating the monthly schedule and total payment breakdown.

How Does an EMI Calculator Work?

Our EMI Calculator is simple to use, easy to comprehend, and quick to use. Using this calculator, you may calculate the EMI for a home loan, a car loan, a personal loan, an education loan, or any other completely amortizing loan.

In the EMI Calculator, enter the following information:

- The principal loan amount that you desire to obtain (rupees)

- Loan duration (months or years)

- Interest rate (percentage)

- EMI in arrears OR EMI in advance (for car loan only)

Adjust the values in the EMI calculator form using the slider. If you need to input more specific values, you can do so directly in the relevant areas above. The EMI calculator automatically recalculates your monthly payment (EMI) amount as soon as you modify the parameters using the slider (or click the 'tab' key after entering the values directly in the input fields).

Calculation of Floating Rate EMI

We recommend that you compute floating / variable rate EMI using two opposing scenarios: optimistic (deflationary) and pessimistic (inflationary). Loan amount and loan tenure, two components necessary to calculate the EMI, are under your control; that is, you will pick how much loan you need to borrow and how long your loan should be. However, banks and HFCs set interest rates based on the RBI's rates and regulations. As a borrower, you should evaluate the two extreme possibilities of interest rate increases and decreases and calculate your EMI under these two scenarios.

This calculator will assist you in determining how much your EMI is affordable, how long your loan term should be, and how much you should borrow.

Optimistic (deflationary) scenario: Assume that interest rates fall by 1% - 3% from their current levels. Consider this scenario and compute your EMI. In this case, your EMI will be reduced, or you may choose to decrease the loan term. For example, if you take out a home loan to buy a property as an investment, an optimistic scenario allows you to compare it to other investment alternatives.

Pessimistic (inflationary) scenario: Assume that interest rates are raised by 1% - 3%. Is it possible for you to continue paying the EMI without any difficulty? Even a 2% increase in interest rates can result in a considerable increase in your monthly payment throughout the life of the loan.

This estimate assists you in planning for such future scenarios. You are making a financial commitment for the next few months, years, or even decades when you take out a loan. Consider both the best and worst-case scenarios...and be prepared for both. In a nutshell, hope for the best but brace yourself for the worst!