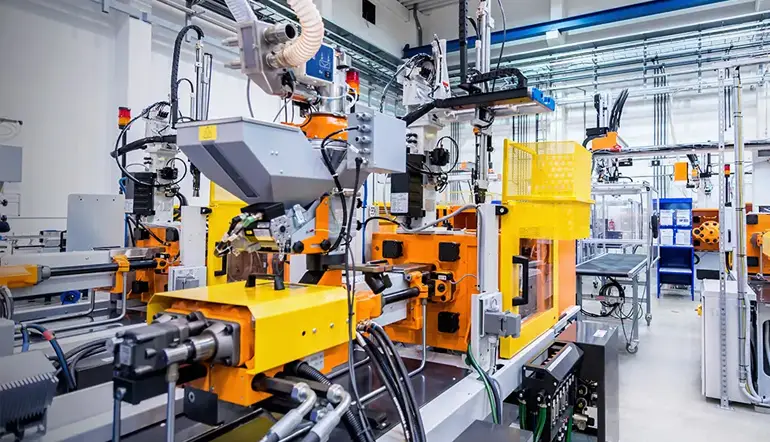

Plant and Machinery Finance

Plant and Machinery Finance

Ezmy Loans provides a variety of customized and flexible plant and machinery finance solutions, such as leasing and hire purchase business loans, to small and medium-sized businesses. We can help firms secure the assets they need to scale their operations by arranging Plant & Machinery finance.

We provide:

- Leasing: Allows you complete use of the asset for a specific period of time without the burden of ownership.

- Purchase of a rental vehicle: Allows you to spread the cost of an asset over a predetermined amount of time while still having the option to buy the asset at the end of the process.

Why choose us:

- The most diverse range of deals from over 21 banks/NBFCs

- The quickest response time

- Direct Deposit to Applicant's Account

- It saves you both time and money.

- Data Safety and Security

The Advantages of Using Plant and Machinery Finance

- Purchase the equipment now and pay later.

- Maintain Cash Flow

- Obtain Newer Models

- Potential Tax Advantages

- Utilize the Most Recent Technology

Eligibility Criteria

- At the time of loan maturity, the applicant's age must be between 21 and 65 years old.

- A minimum of two years' business vintage is required.

- The applicant should not have a history of loan defaults.

Documents Required

- Latest Passport Size Photo

- PAN Card, Aadhaar Card, Passport, Voter’s ID card, Driving License, Utility Bills (Water and Electricity Bills)

- Income Proof

- Business vintage and existence proof

- ITR of last two years

- Last 1 year bank statement

- Existing facility sanction letter

- Original and valid quotation of the machine(s) – To be purchased

1. What are the advantages of a Machinery Loan?

- Quick and easy access to liquidity in a short period of time

- There is no need for collateral.

- Quick processing

- Interest Rates Are Low

When you need funds for a specified end-use reason, you can request for a Loan against Gold.

2. Is a Machinery Loan Collateral Required?

No, because this loan arrangement does not require any collateral or assets to be pledged.

3. What is the current interest rate on a machinery loan?

The interest rate on a machinery loan starts at 5.50% and goes up from there.