Blog Details

What is the Significance of NOC?

When a borrower obtains the loan and successfully pays off all of the EMIs regularly, he feels relieved because the debt has been paid. However, if the borrower has not obtained the NOC from the creditor, he may be in trouble.

What is NOC?

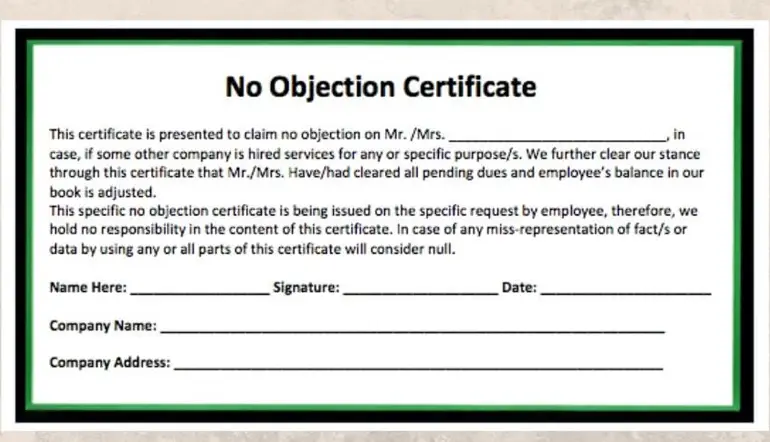

A no objection certificate (NOC) is also referred to as a no due certificate. NOC, or no objection certificate, is a legally binding document issued by the loan company or a creditor stating that the loan has been fully paid off and that the lender owes no money.

It is crucial to obtain a NOC from the creditor once the debt has been entirely paid off. You can obtain a NOC following the completion of all types of loans.

The Requirement for a NOC

When you apply for a loan, you must submit some such papers to the lender (for example, original property documents), which remain in the lender's captivity until the loan is ended. It is advantageous for the borrower to obtain those documents after the dues have been paid.

If a person wants to avoid future issues, he or she must collect the NOC after the loan is ended. If you have a NOC, it will serve as proof that you do not owe any money.

Steps to Obtain a NOC

- Personal Loan: The borrower must write a formal letter requesting a NOC letter from the lender.

- Vehicle Loan: The lender issues a NOC as well as the RTO form for a vehicle loan (form 35). These must be submitted to the regional transportation office as well as the relevant insurance company.

- Home loan: Once the borrower has paid all current debt payments, he can visit the lender branch or write a letter to the creditor requesting that all paper records, billing copies, and NOC be returned. The papers and NOC are usually handed back to an individual within a few working days.

2 Comments

Kevin Martin

Lorem ipsum is simply free text used by copytyping refreshing. Neque porro est qui dolorem ipsum quia quaed inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Kevin Martin

Lorem ipsum is simply free text used by copytyping refreshing. Neque porro est qui dolorem ipsum quia quaed inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.